Watchmaking is a story of passion, a fascination for the mechanics of time, the elegance of complications, and the craftsmanship of renowned watchmakers. But passion comes at a price. And if you're reading this article, it means you'd prefer your passion to also be beneficial to your wallet. Buying a watch can be a pleasure, but it's also an investment—a way to combine passion with financial sense. Not all watches appreciate in value, but certain models never lose ground, and others, carefully chosen, can explode in value on the secondary market.

So, what are the watches that withstand market fluctuations and whose value never stops growing? Which timepieces, besides being masterpieces, represent a real store of value?

Rolex Submariner : The Essential Safe Haven

If there’s one watch that must be mentioned first when discussing watch investment, it's the Rolex Submariner. Since its creation in 1953, it has never lost its status as the ultimate dive watch. Its design is timeless, its market value unshakeable, and demand has never truly declined.

A Submariner purchased twenty years ago has often doubled or tripled in value, especially iconic references like the 16610 or 5513, now cherished by collectors. Even modern models with ceramic bezels and optimized calibers remain secure investments due to strong demand and limited boutique availability.

Why such stability? Because the Submariner never goes out of style. Whether in steel, gold, or the green "Hulk" edition, its appeal remains constant. Purchasing one will never be a mistake.

Patek Philippe Nautilus : le symbole de la rareté

If there's one watch that has exceeded all expectations in terms of appreciation, it’s the Patek Philippe Nautilus. Designed by Gérald Genta in 1976, it’s now one of the most sought-after watches globally.

Its most iconic model, the Nautilus 5711, saw its value skyrocket after production ceased, reaching prices of over €150,000 on the secondary market, despite initially retailing around €30,000 in boutiques.

What explains this dramatic rise? Patek Philippe tightly controls its production, creating scarcity that fuels demand. If you're fortunate enough to own one, you hold a timepiece whose value will keep climbing.

Audemars Piguet Royal Oak : The Steel Revolution

Another Gérald Genta creation, the Audemars Piguet Royal Oak, revolutionized luxury watchmaking in 1972. A sporty watch in steel priced higher than some gold models? At the time, it was daring. Today, it’s an absolute legend.

Highly coveted versions, like the Royal Oak 15202ST, are nearly impossible to find in boutiques. On the secondary market, their prices have exploded, far surpassing official retail.

Why invest in a Royal Oak? Because it offers timeless design, limited production, and a demand consistently greater than supply. In short, its value never declines.

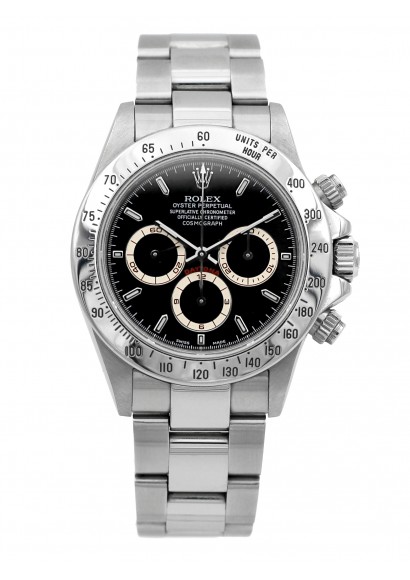

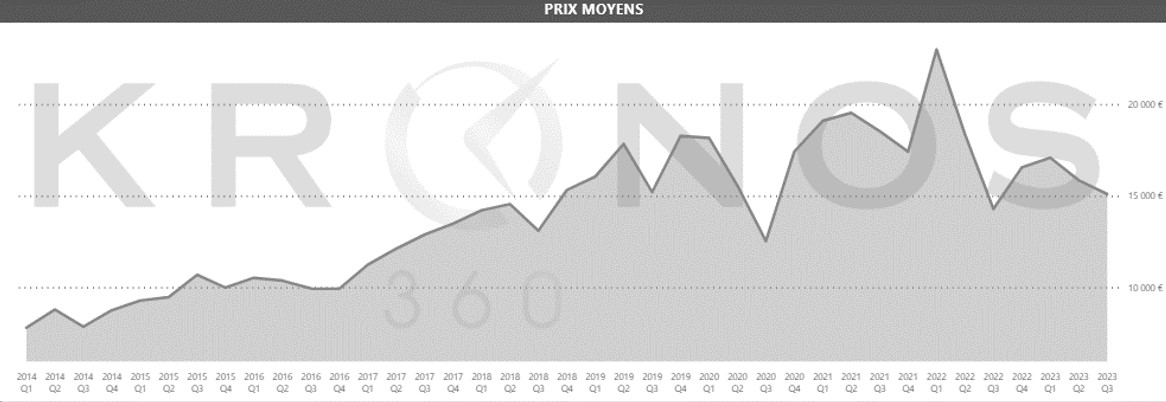

Rolex Daytona : The Most Coveted Chronograph

The Rolex Daytona, now a titan of the watch market, didn't always enjoy this status. In its early days, it struggled to find buyers. Yet history rewrote itself, and today, each new Daytona release is a true investment gem.

Vintage models, notably the Paul Newman Ref. 6239, achieve astronomical prices at auction. Even modern references, like the 116500LN, quickly surpass their retail prices, underscoring consistently strong demand.

Why such success? Because the Daytona is unique—a legendary chronograph whose value continually grows.

Omega Speedmaster Professional : The Moonwatch Myth

Among watches that retain value, Omega’s Speedmaster "Moonwatch" is a cornerstone. It was the first watch worn on the Moon in 1969, and this historical aura makes it highly desirable.

Older models, particularly the pre-Moon caliber 321 versions, are now golden investments, and even more recent editions steadily appreciate.

Why choose a Speedmaster? Because it's timeless, historic, and more accessible than previous models while remaining a reliable watch investment.

Conclusion: Investing Intelligently in a Watch

Not every watch is a profitable investment. Some lose value sharply, others remain stagnant. But subtle, rare, timeless models take their time to establish value and become coveted assets. Rolex, Patek Philippe, Audemars Piguet, Omega—these brands have created timeless icons whose demand vastly outstrips supply, guaranteeing stability or even appreciation over time.

Investing in a watch shouldn't be merely a financial transaction. Above all, it means choosing a piece that speaks to you, tells a story, and whose aesthetic and monetary value will accompany you through time. A carefully chosen watch becomes more than just a pleasurable object—it’s an heirloom, a legacy, a fragment of eternity.

Article written by Chris Samassa, founder of Osterman Watch